Content

And customers can be happy that they get a better price than they were hoping to get. The more order flow the market makers receive from the likes of Robinhood, the more profit they can generate from the https://www.xcritical.com/ bid-ask spread. Brokerages earn more when they send more trades to the market makers. A market maker buys shares of stock at a lower price than the price at which it sells shares, a difference known as the bid-ask spread. In order to buy and sell shares of Pets.com, investors were typically paying commissions of around $40 per trade.

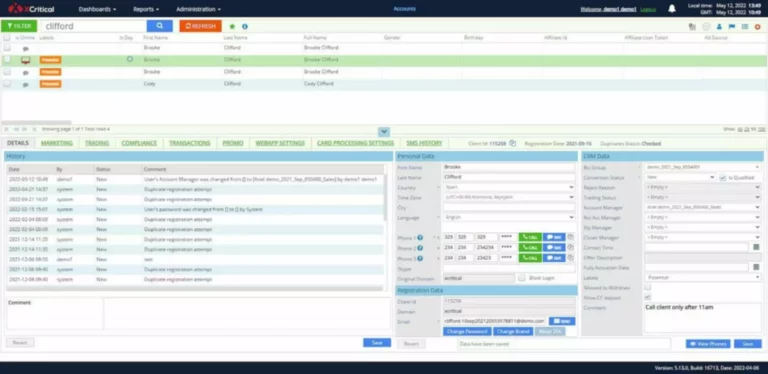

Key Steps in an Efficient Order to Cash Process

- Plans involve continuous investments, regardless of market conditions.

- Securities and Exchange Commission (SEC) requires broker-dealers to disclose their PFOF practice in an attempt to ensure investor confidence.

- Online brokers with zero-commission trading tend to attract a wide array of investors.

- Many brokerages discovered a feature called the payment for order flow.

- Historical or hypothetical performance results are presented for illustrative purposes only.

- Lastly, many institutional traders do not want to show their orders at the exchanges for fear of driving the price away from themselves.

Even if pfof meaning the SEC implements new rules, there would first be a period of public debate and comment before anything is implemented. While there is a lot of smoke at the moment, equity market structure reform is still in the very early stages, said Bank of America managing director Craig Siegenthaler. Meanwhile the Financial Industry Regulatory Authority (FINRA) conducts examinations and audits to ensure brokers are meeting best execution standards. Regulators are now scrutinizing PFOF—the SEC is reviewing a new major proposal to revise the practice, and the EU is phasing it out by 2026—as critics point to the conflict of interest that such payments could cause.

What’s Vanguard’s PFOF philosophy?

It is not intended to constitute investment advice or any other kind of professional advice and should not be relied upon as such. Before taking action based on any such information, we encourage you to consult with the appropriate professionals. Market and economic views are subject to change without notice and may be untimely when presented here. Do not infer or assume that any securities, sectors or markets described in this article were or will be profitable. Historical or hypothetical performance results are presented for illustrative purposes only.

Why payment for order flow is a good deal for investors

Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Buying one national currency while selling another is known as forex trading. In short, we don’t receive (or take) any form of payment for order flow.

That number was up from $892 million the year prior, meaning PFOF profits nearly tripled in just one year. PFOF is used to transfer some of the trading profits from the market makers back to the brokers. The ultimate purpose of PFOF is for liquidity, not necessarily to profit off client orders.

The Regulation National Market System (NMS), enacted in 2005, is a set of rules aimed at increasing transparency in the stock market. Most relevant here are the rules designed to ensure that investors receive the best price execution for their orders by requiring brokers to route orders to achieve the best possible price. Nevertheless, brokers have a strong incentive to encourage more options trading, especially in a zero-commission trading environment. According to a 2022 study, which is in line with similar reporting and studies, about 65% of the total PFOF received by brokers in the period studied came from options.

One of the significant updates to this rule was in 2018, where the SEC adopted amendments to enhance the transparency of order handling practices. These amendments expanded the scope of the original rule, leading to what is currently known as Rule 606(a). Right now, the SEC is still in the ideas phase, and there’s no timeline when the commission will conclude its research.

In response, the SEC introduced Rule 606 (formerly Rule 11Ac1-6[21]) under the Securities Exchange Act of 1934, aiming to address these concerns. The rule has undergone several amendments to keep pace with the evolving market structure, technological advancements, and trading practices. This third party is known as a market maker and are large financial institutions, such as Citadel Securities, that provide liquidity to the market by both buying and selling securities. Robinhood, the zero-commission online broker, earned between 65% and 80% of its quarterly revenue from PFOF over the last several years. Market makers, who act as buyers and sellers of securities on behalf of an exchange, compete for business from broker-dealers in two ways.

While PFOF is thought by many to have a conflict of interest, it has remained the status quo. It wasnt until the GameStop (GME) meme stock saga in 2021 that investors became more outspoken about PFOF and broker-dealer transparency. In fact, SEC Chair Gary Gensler said after the Gamestop saga that payment for order flow can raise real issues around conflicts of interest.

This can result in constant cancelled orders which may frustrate traders to the point of chasing prices to get a fill or even placing market orders. Larger sized orders can be expected to show up on level 2 which can further push prices away and again cause the trader to cancel and chase fills. This is particularly damaging in fast moving volatile markets and stocks with wide spreads.

Bonds with higher yields or offered by issuers with lower credit ratings generally carry a higher degree of risk. All fixed income securities are subject to price change and availability, and yield is subject to change. Bond ratings, if provided, are third party opinions on the overall bond’s credit worthiness at the time the rating is assigned.

Investors should always be aware of whether or not a broker is using PFOF and selling your trade orders to a market maker. Direct routing to the exchanges is more expensive, which is why were turning what used to be a revenue stream (ahemPFOF) into a cost center. And forgoing PFOF allows us to promote our core values of a transparent investing environment, as the practice can go against the positive impact that many investors have in mind when they envision a better world. So while the investor gets the stock of Company A for the price they wanted, its not necessarily the best price execution quality. Thats one reason why Public doesnt use PFOF- to reduce this potential conflict of interest and attempt to get investors better prices.

Traders discovered that some of their “free” trades were costing them more because they weren’t getting the best prices for their orders. PFOF is how brokers get paid by market makers for routing client orders to them. In the 2010s, brokers were forced into a race for the lowest fees possible, given the competition. PFOF allowed the brokerages to make up for lost customer commissions. It can come as a fee per trade, a share of the spread, or other financial incentives. Investors seek quality price execution, and that starts with the right brokerage.